Provide your clients' value added tax number and show it on the invoices.

🔓 Required permissions

Team : View Invoices and Manage Invoices

Project : View Invoices and Manage Invoices

| Reading time | 2 minute |

| Setup length | 2 minute |

| Steps | 2 |

Summary

I/ Add the VAT on the client's profile

II/ Display the client's VAT on the invoice.

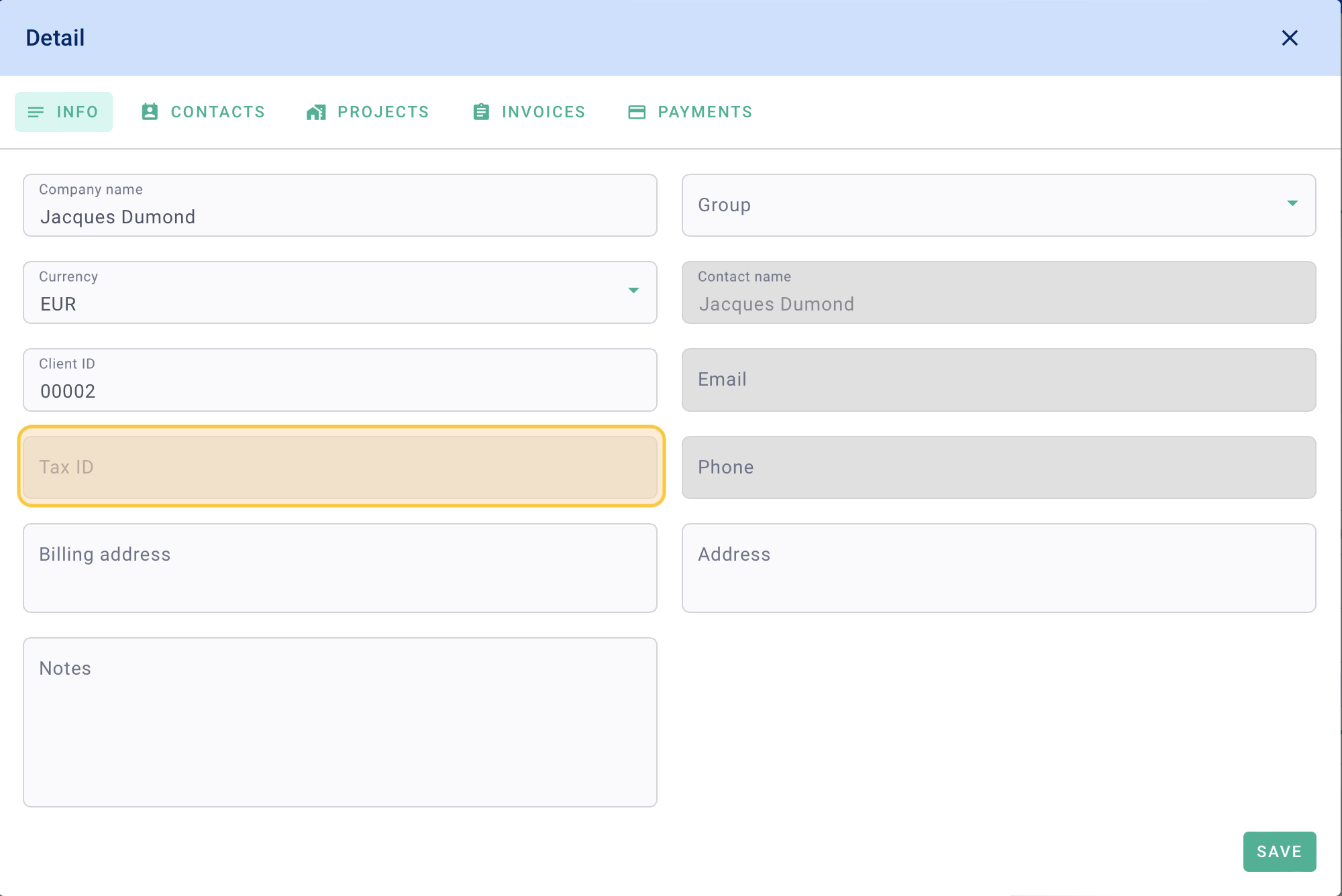

I/ Add the VAT on the client's profile

Go to the client's profile to add their VAT.

⚠️ Warning, you need to enter one VAT per client profile.

Click on Invoices in the left menu > go to the Clients tab, select the client's profile, and fill in the field "Tax ID" provided for this purpose.

Be sure to Save the changes.

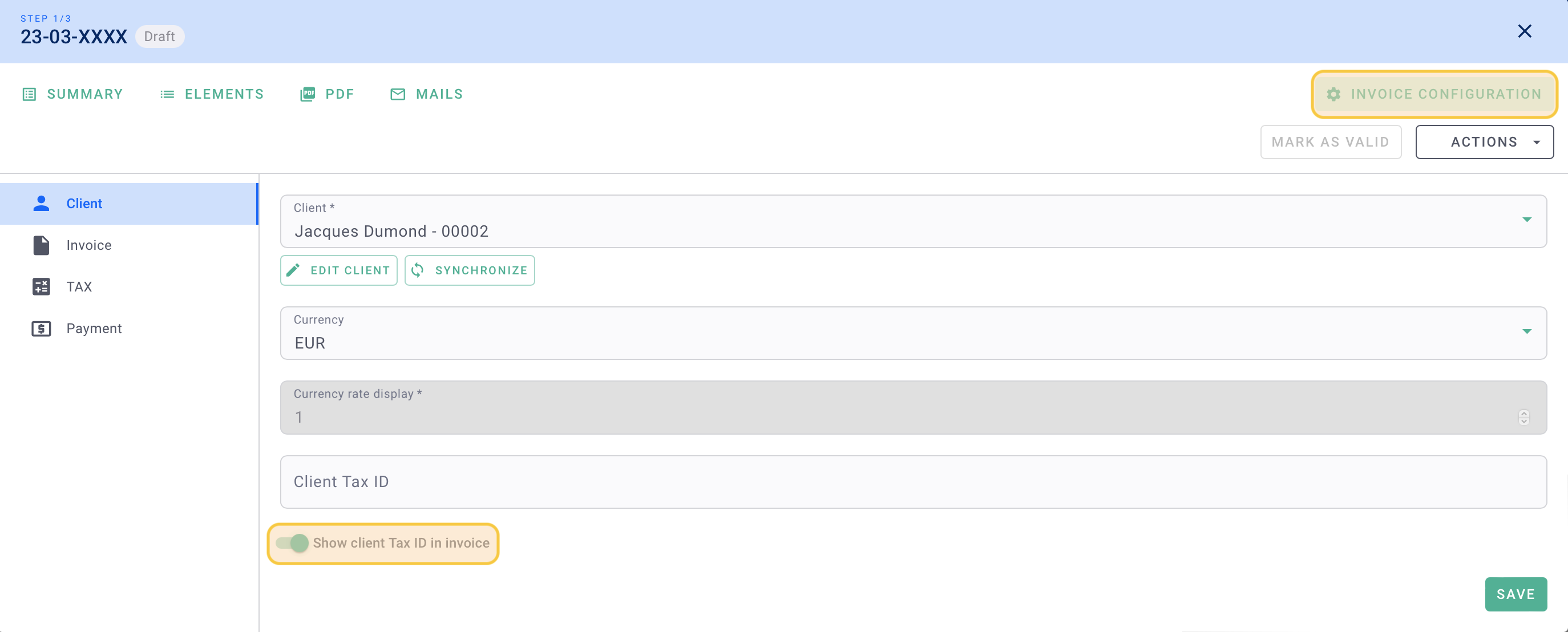

II/ Display the client's VAT on the invoice

Once the VAT number is added to the client's profile, go to the invoice in the Invoices tab > click on + Invoice > select the Project, Invoice Type, and Client > click on Save.

Next, click on the Invoice Configuration tab on the right in green > go to the Client tab on the left > enable the last module "Show client Taxe ID in invoice". Save the changes.

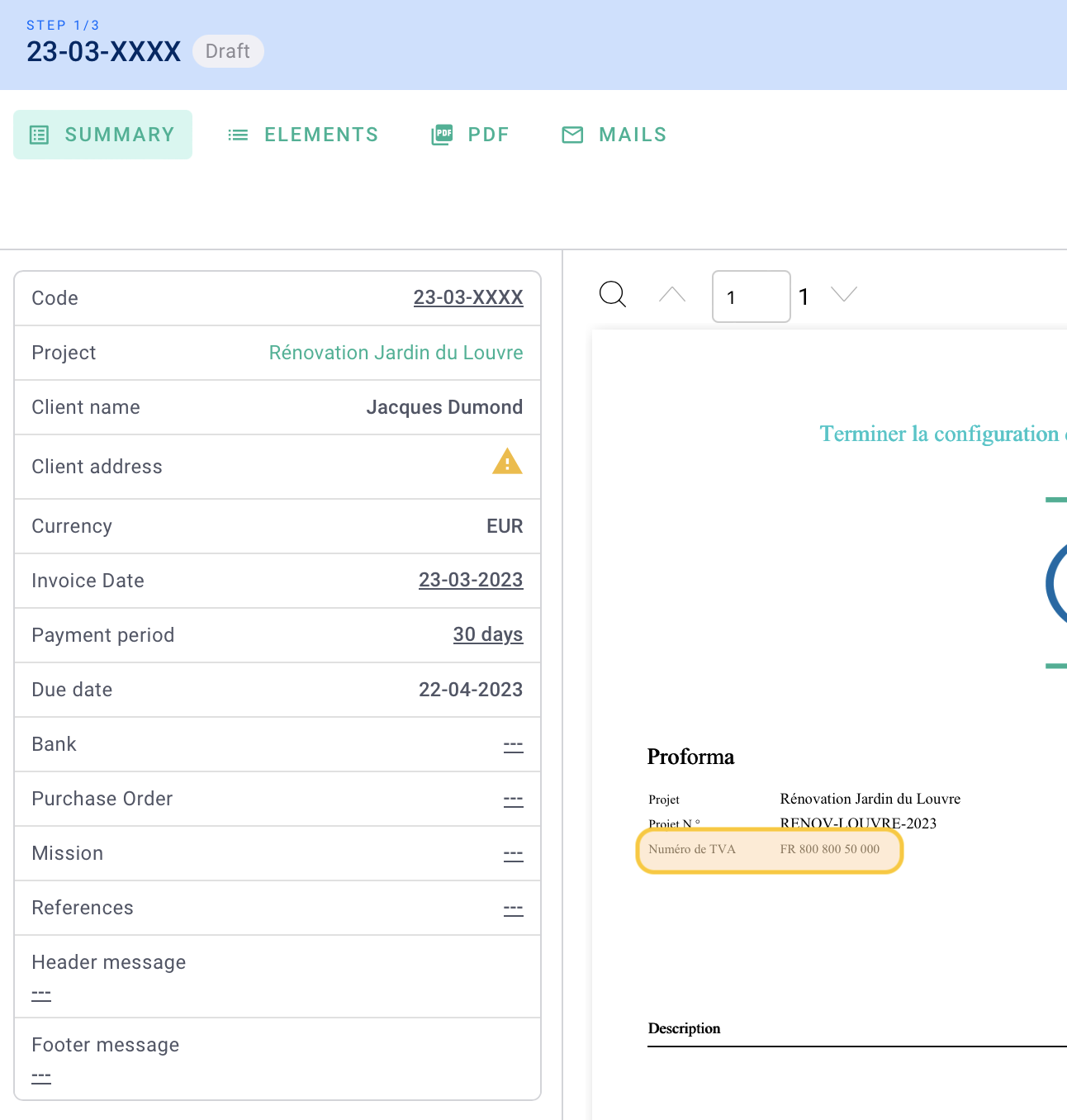

Now, go back to the Summary tab of your invoice, and the VAT number will be displayed at the top left of your document.

The setup is complete! 🎉