Set the default VAT rate on all invoices for your project. Activate a multi-VAT module so that each phase has its own VAT rate.

🔓 Required permissions

Team : View invoices and Manage invoices

Project : View invoices and Manage invoices

| Reading time | 2 min |

| Setup length | 2 min |

| Steps | 3 |

Summary

I/ Set the default VAT on a project

II/ Change the VAT on an invoice

III/ Activate Multi-taxes on a project

IV/ Activate Multi-taxes for your subcontractors/co-contractors

I/ Set the default VAT on a project

All invoices for the project will have the same VAT rate.

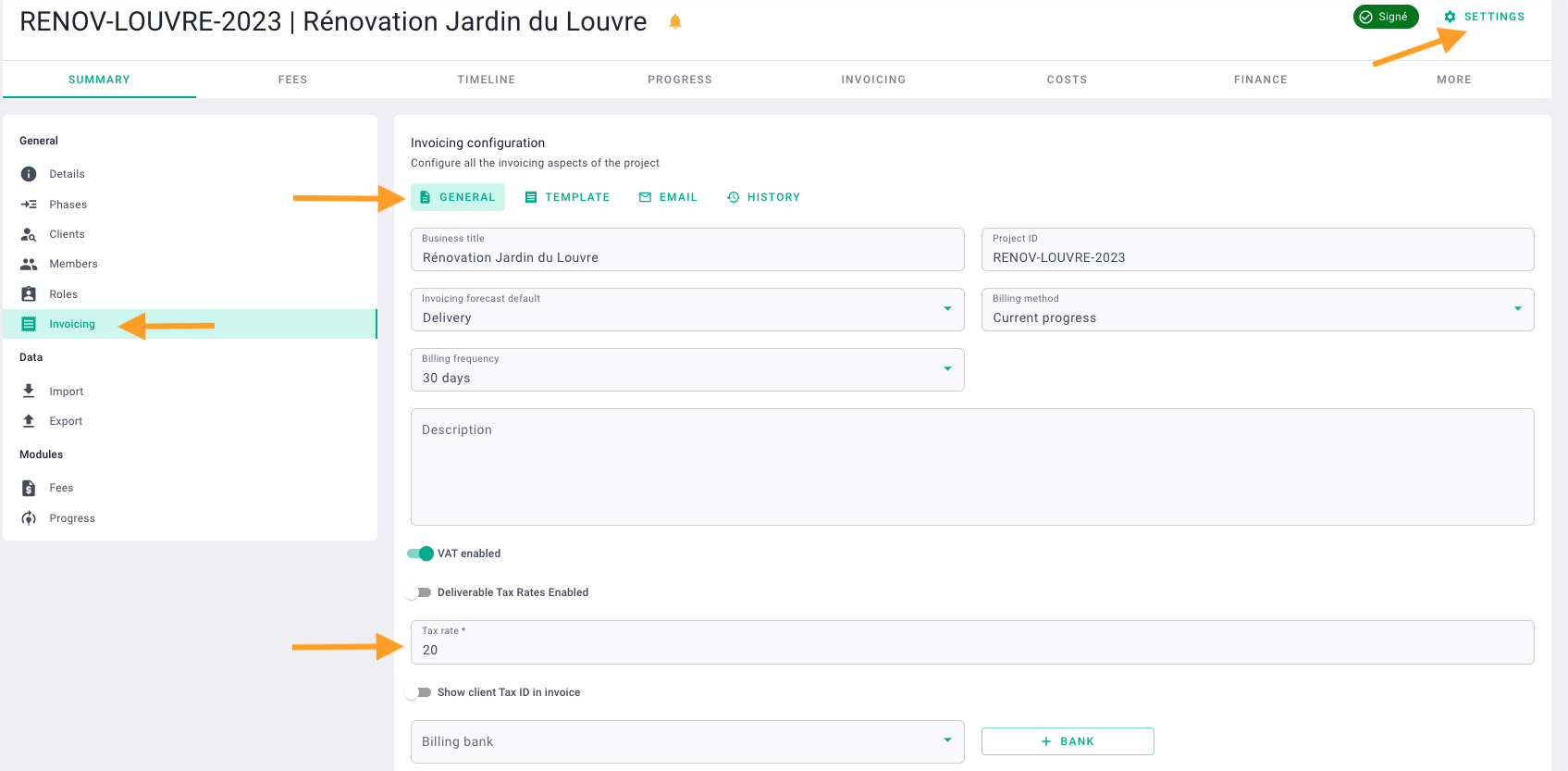

Go to the Project, then click on Settings at the top right in green > Invoicing on the left > General tab > enter the default VAT rate for the project in the VAT Rate field. All invoices for the project will have the same VAT rate.

There you go! 🎉

II/ Change the VAT on an invoice

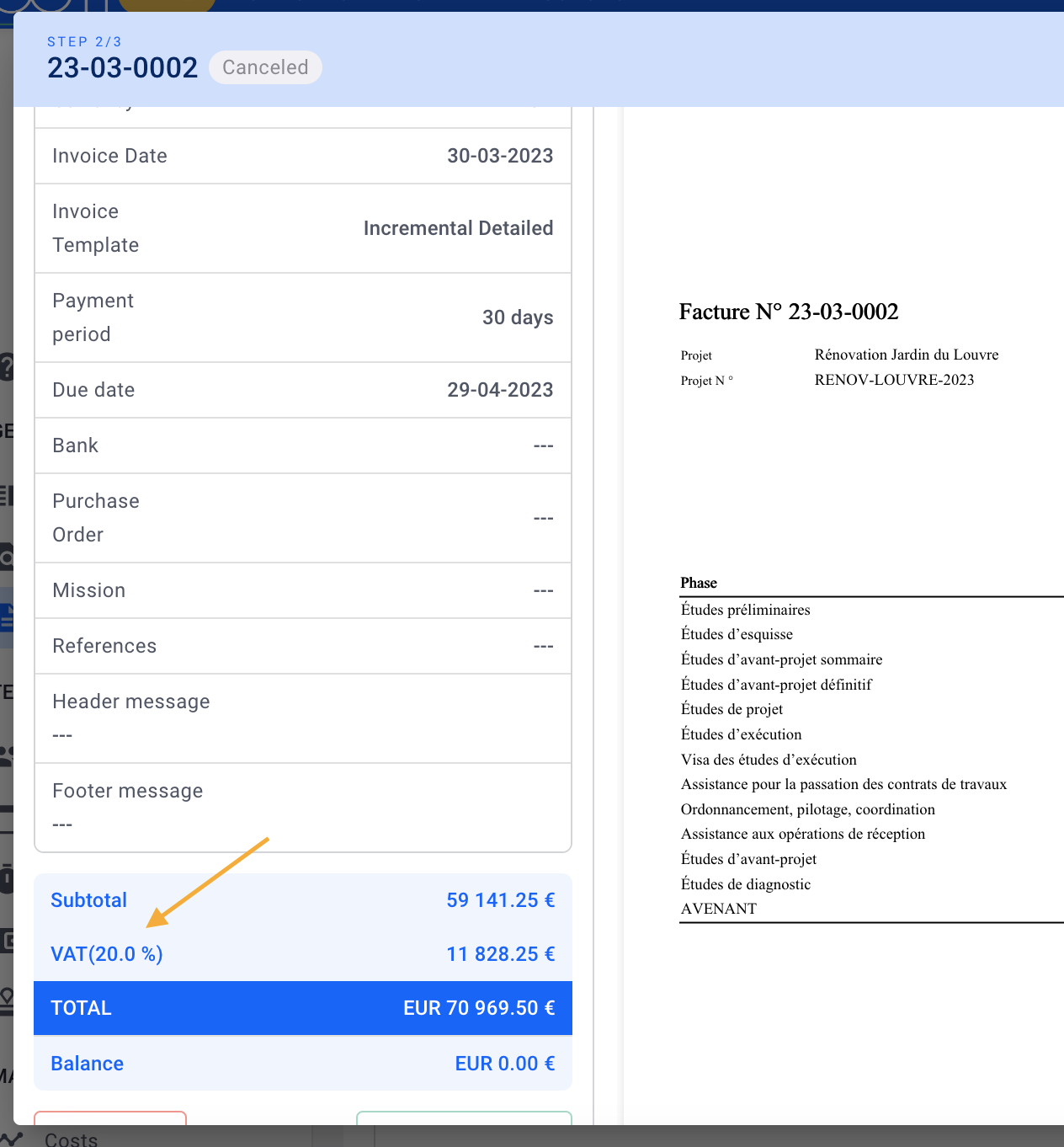

You can change the VAT for each invoice at the bottom left in the Summary tab by clicking on the underlined 20%.

There you go! 🎉

III/ Activate Multi-VAT on a project

If you want to add multiple VAT rates on your project, the first step is to activate the "Multiple Taxes" module, from your Account Settings > Modules > Invoicing > "Multiple Tax".

Still from the settings, then click Invoicing > Taxes and add the taxes used in your projects.

When creating your project, fill in the field "tax rate" the rates applied on your project.

By default when invoicing, the different rates chosen will all be applied on all phases and you will have the hand to delete some.

There you go! 🎉

You will then find your various VAT totals by rate on your invoice and in the total on the left side of the summary tab of your invoice.

IV/ Activate Multi-taxes for your subcontractors/co-contractors

From the fees tab, click on "Manage companies" to add your subcontractor/co-contractor and set a default VAT rate.

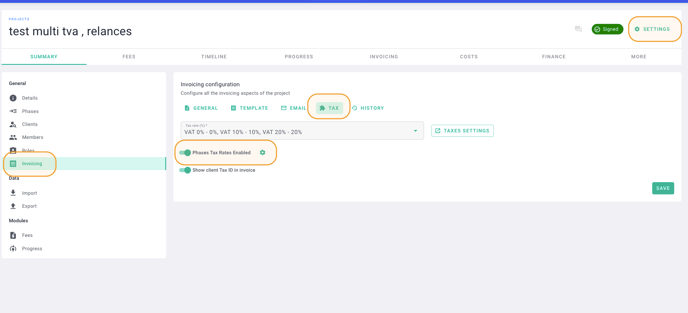

From your project settings > Invoicing > Tax > enable "phases tax rates enabled".

Click on the gear icon next to the module, then click on "point of view" to access the view of your co-contractor/subcontractor.

Then set the VAT rates applied to the different phases for your co-contractor/subcontractor.

That's it! 🎉 You will find the subtotals with VAT details in the PDFs related to the invoice for your co-contractor/subcontractor.